Our Products

Seed Capital provides financial services to the unserved and underserved people so that they can start or expand their small businesses and increase their incomes. The company is offering financial services to the resource poor, unbanked and marginalized people in rural and semi-urban areas. The services aim to meet the evolving needs of community and people who are involved in agricultural and small business activities. SCPL uses the group lending (SHG and JLG) where poor woman guarantee each other’s loans. Borrower undergo financial literacy training and must pass a test before they can avail loans. Monthly/Weekly/Fortnightly meeting with borrower follow a highly disciplined approach. Re-payment rates on the Company’s collateral-free loans are more than 99% because of it’s regular monitoring and follow up on loan utilization. The company has introduced large size individual loans to provide financial assistance to the MSME segment. It has also introduced individual’s loans.

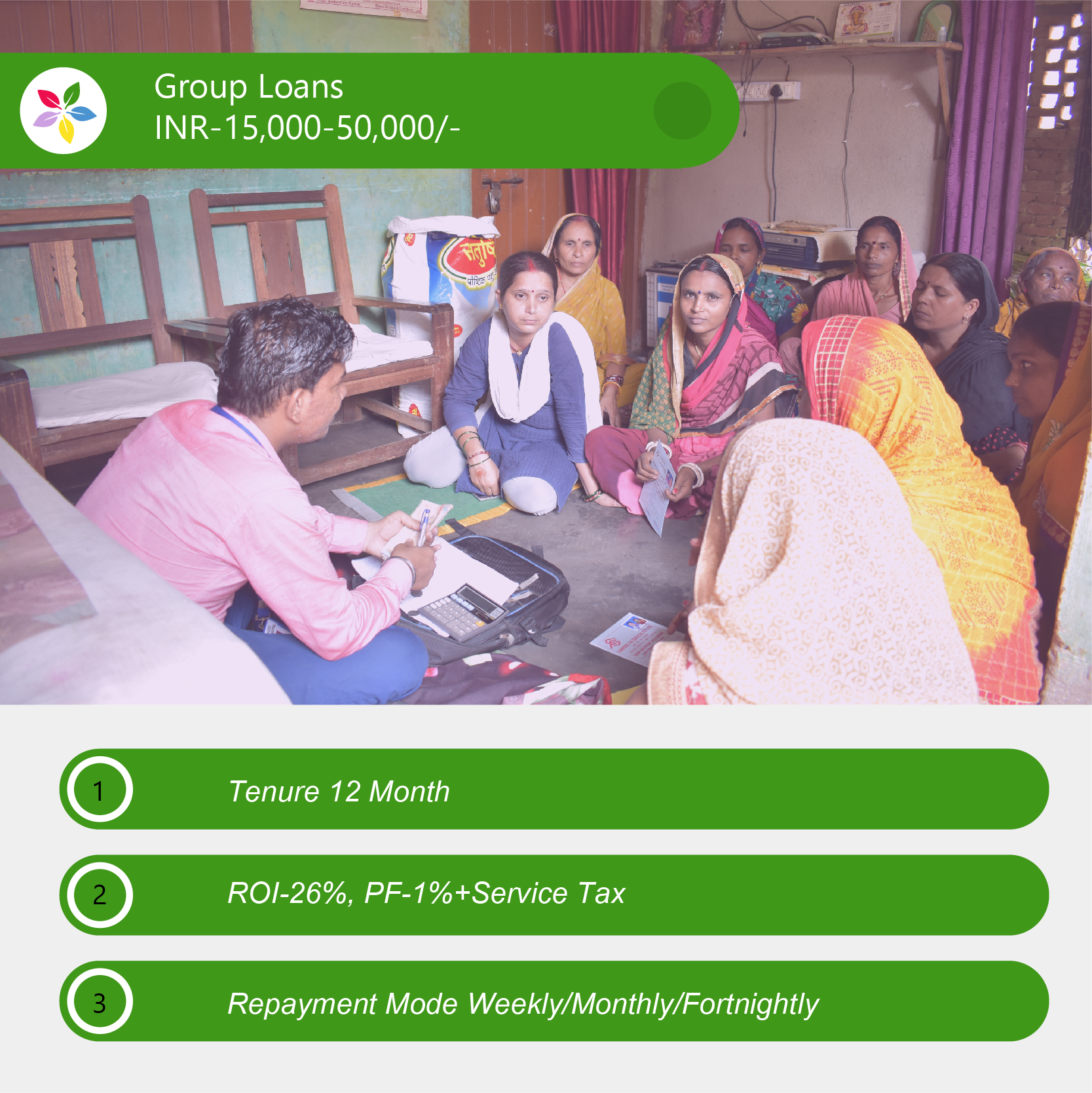

Income Generation Loans are smaller loans given to our SHG/ JLG clients, at lower interest rated and shorter duration with the purpose of empowering them.

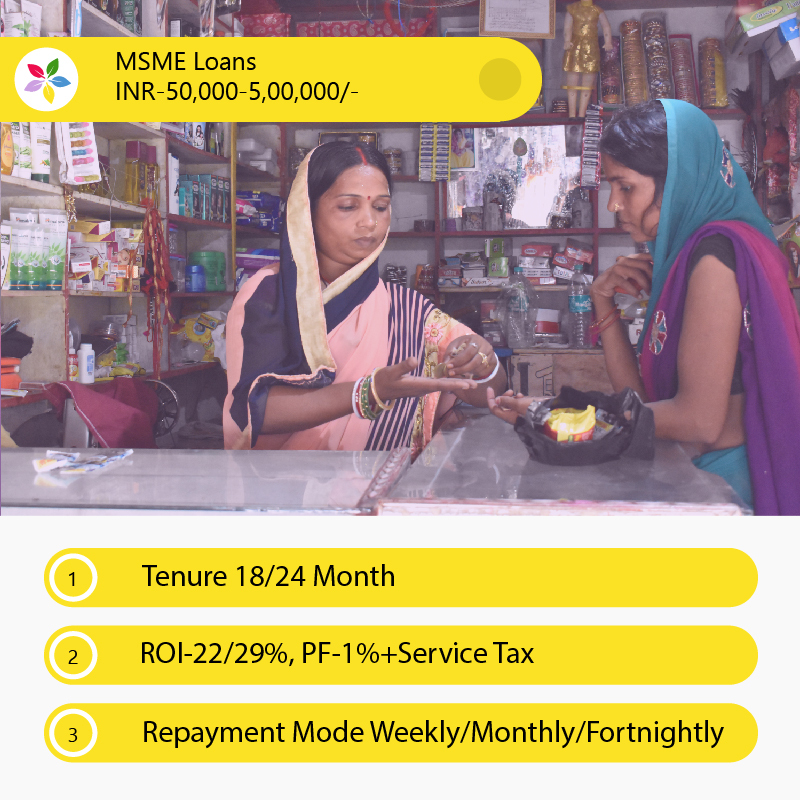

Seed Capital offers Business loans to micro, small and medium enterprises to meet their capital needs. Our superfast turnaround time means that you can take things from planning to execution within a matter of days instead of week or months. An MSME loan from Seed Capital allows you to get ahead in product marketing, boost production and expand your supply network in no time at all.

SCPL provides financial support to individuals for safe water and sanitation facilities. We created the water credit Initiative to address this barrier head-on. Water credit helps bring small loans to those who need access to affordable financing and expert resources to make household water and sanitation solution a reality.

SCPL provides loan for purchase Buffalo, Cow, dairy related equipment, cattle equipment for farming and irrigation and other agricultural requirements. This loan is provided to dairy and agricultural societies for modernization and creating infrastructure. We provide finance for starting a new dairy farm or expanding an existing dairy farm. The facility can be availed as term loan. We also provide quick and easy loans for starting up and developing your Agri-allied businesses.

SCPL provides Housing/Repairing loans to individual for Home constriction, Home renovation and their repair. SCPL addresses the housing finance need of the poor an unprivileged customer in rural and urban areas of Bihar. We provide low cost housing loan/house improvement loan with an easy repayment provisions to help our existing customer see their dreams come true.